Vermont Home Energy Rebates: Transforming Efficiency and Comfort for Vermonters

In 2022, Congress passed the Inflation Reduction Act, unlocking historic funding to help Americans lower energy costs, boost home efficiency, and reduce greenhouse gas emissions. Sections 50121 and 50122 of the IRA established the Home Efficiency Rebate Program (HOMES) and the Home Electrification and Appliance Rebate Program (HEAR), respectively. The HOMES program is designed to support deep energy retrofits and weatherization projects that enhance the overall efficiency of homes. Meanwhile, HEAR focuses on helping households transition to modern, energy-efficient electric appliances and systems. Per statute, HOMES and HEAR are income-restricted programs; only available to low-income and moderate-income households. The IRA defines a “low-income household” as one in which total annual income is less than 80% of the area median income (AMI) and moderate income as a household in which total annual income is less than 150% AMI. Vermonters can check whether their households meets area median income requirements here: 2024_AMI_50_80_100_150_EL_from_HUD_240813_Update.xlsx

In Vermont, HOMES will offer low-income households up to $16,000 of efficiency upgrades delivered through the Weatherization Assistance Program at no cost to residents. HEAR will offer low- and moderate-income households up to $8,000 for heat pump installations. A 50% cost match is required to participate in the moderate-income program. One-third of the HEAR award will specifically support efficient electrification in new affordable housing. The Vermont Department of Public Service received $29 million in funding for each program, totaling $58 million to support energy-saving home improvements for Vermonters. Read on to learn more about how Vermont’s Home Energy Rebate programs will work, including details on timeline, eligibility, rebate amounts, and how you can get started.

***Please note that rebates are NOT available prior to program launch and rebates cannot be issued retroactively. ***

Home Electrification and Appliance Rebate Program (HEAR)

The Vermont HEAR program will roll out in three phases to support the transition to energy-efficient electric heating and appliances.

Program 1: Heat Pump Incentives for Moderate-Income Households (Expected to begin accepting applications July 1, 2025)

$9 million of Vermont’s HEAR award will fund a Moderate Income Heat Pump Rebate program to support heat pump installations for moderate-income households, defined as those earning between 80-150% of the Area Median Income (AMI). Check your household income against AMI here: 2024_AMI_50_80_100_150_EL_from_HUD_240813_Update.xlsx.

Under the IRA, eligible moderate-income households can receive rebates covering up to 50% of the cost of adding heat pumps to their homes, up to a maximum of $8,000 per household.

To qualify, the installed heat pump must be the primary heating source for the home, accounting for at least 50% of the household’s thermal energy usage. Rebates will not be issued for heat pumps that do not meet the primary heating requirement.

The Moderate-Income Heat Pump Rebate program will be administered by Efficiency Vermont and is expected to launch in the spring of 2025.

Program 2: No-Cost Heat Pump Installations for Weatherized Low-Income Homes (Expected to launch July 1, 2025)

$10 million of Vermont’s HEAR award will be dedicated to installing heat pumps in qualifying low-income households served by the Weatherization Assistance Program (WAP). The WAP provides weatherization and electrification services at no cost to low-income households, i.e. households whose income is below 80% of the Area Median Income. To participate in this program, reach out to your local Community Action Agency.

Program 3: Electrification Assistance for New Affordable Multifamily Housing (Expected to launch July 1, 2025)

$10 million of Vermont's HEAR award will expand Efficiency Vermont’s existing new construction program to provide electrification assistance for new Affordable Multifamily Housing. This approach will incentivize the construction of energy-efficient, fully electrified affordable housing. Rebates will be issued exclusively to affordable housing developers with established income verification protocols in place. These funds will help offset the higher costs of incorporating energy-efficiency and electrification in new construction.

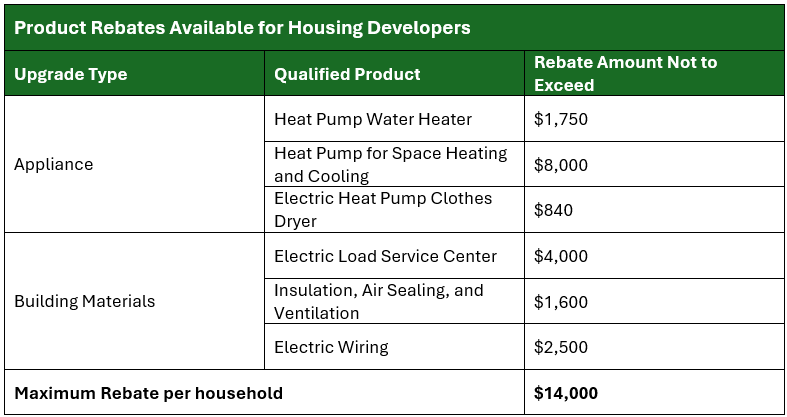

Developers can apply for IRA rebates, which offer up to $14,000 per unit for qualifying electrification measures, to electrify units for low-income households (below 80% AMI) and moderate-income households (80-150% AMI). Eligible projects include rebates for building-wide systems, such as heat pumps for space heating and cooling, heat pump water heaters, electric panels, and more. See below for the full list of incentives. To participate in this program, housing developers should contact Efficiency Vermont early in the design phase to access technical support and streamline rebate administration. Contact Efficiency Vermont to learn how to participate in this program.

Home Efficiency Rebates (HOMES)

Vermont’s $29 million HOMES award will deliver comprehensive energy efficiency upgrades to low-income households (those earning less than 80% area median income) at no cost to participants through the Weatherization Assistance Program (WAP). Please contact your local Community Action Agency to learn if you are eligible.

Note: The IRA funded weatherization program launches July 1, 2025, but eligible households can sign up for weatherization services today through their Community Action Agency, linked above.

The Department of Public Service held a public meeting on its proposed Home Energy Rebate program designs. To access the recording of the June 4th, 2024 public meeting presentation please see The Vermont IRA Home Energy Rebates Program Public Meeting (youtube video).

If you have outstanding questions about the Home Energy Rebate program, please contact the Energy Program Specialist at Ian.Lund@vermont.gov

For media inquiries, contact State Energy Office Director Melissa Bailey at Melissa.Bailey@vermont.gov

Helpful links (updated July 12, 2023):

- IRS Going Green Could Help Taxpayers Qualify for Expanded Home Energy Tax Credits

- Department of Energy Energy Savings hub

- IRS Credits and Deductions under the Inflation Reduction Act of 2022

- IRS Home Energy Tax Credits

- Available Tax Credits 2022 and 2023-2032 (DOE)

- Weatherization Assistance Program (DOE)